Berlin’s importance in Blockchain discussions

Ricardo Garcia, VP of BerChain

Christoph Iwanuez, the Chief Financial Officer of Nuri

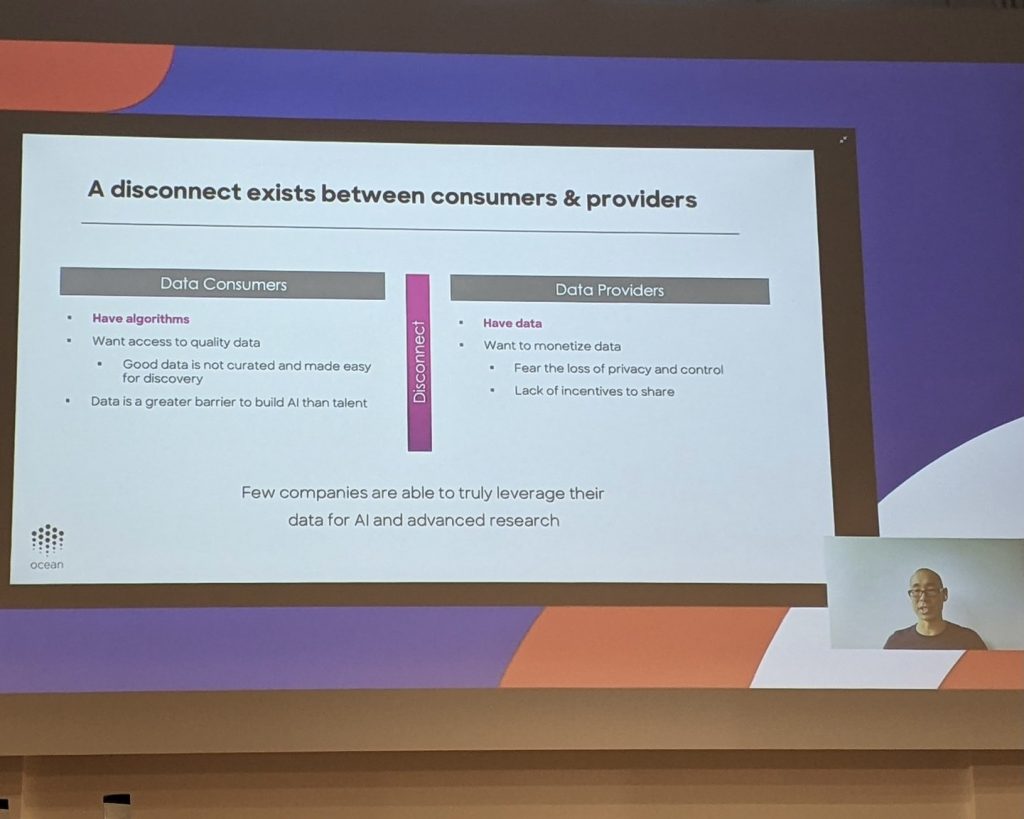

Giving control back to users

Unlike the highly centralized products, apps, and services we use in our day to day, where users have fairly little control over their data, the Blockchain ecosystem offers a way out.- Bruce Pon, Founder, Ocean Protocol

- Marvin Tong , Founder and CEO, Phala Network

Kamal Laungani, Global Developer Ecosystem Lead at Affinidi

Data ownership

Speakers: Marvin Tong, Co-founder at Phala Network ; Joachim Lohkamp, CEO and Founder at Jolocom; Stepan Gershuni, Lead Product Manager at Affinidi; Moderator: Diksha Dutta, Podcast host Voices of Data Economy

Blockchain for Social Good

Moving on from the decentralised data, the conversations focused on how Blockchain could be used for social good. On this front, there were two startups that were doing just that.

Quy Vo-Reinhard, Co-Founder, dHealth Foundation